What are you searching for?

Online Banking

In most cases, external accounts can be verified and linked instantly. If your other financial institution can't be verified automatically, you can still choose the manual entry option and link your account using your routing and account number. This process takes about 1-3 business days.

Learn more about the process here.

To add an external account, log in to Solarity online or mobile banking, go to "Transfers and Payments" and select "External Transfers" in the drop-down menu.

Click "Manage external accounts" and "Link External Account." Follow the prompts to instantly link your external account.

If your financial institution isn't listed or can't be verified automatically, you can choose manual entry and link your account using your routing and account number. This process takes about 1–3 business days.

Learn more about the process here.

You are eligible to make an external transfer if:

- you are 18 years of age or older,

- you have a street address on file with us (P.O. Boxes are not eligible),

- you have a Solarity personal checking, savings or money market account or an eligible Solarity mortgage, loan, line of credit or other personal account and

- you have an eligible external account at another U.S. financial institution.

*We reserve the right to remove availability of this service at any time without warning. Please see Membership Account Agreement Electronic Funds Transfers section to learn more.

**At this time, business accounts are not eligible to make external transfers.

An external deposit account at another U.S. financial institution is eligible as long you are:

- the primary owner of the external account,

- a joint owner of the external account, or

- authorized by all owners of the external account to transfer funds to or from the external account.

An external transfer is an electronic transfer of money to your Solarity account from your eligible external account at another U.S. financial institution.

External transfers also allow you to transfer funds to your external account from your Solarity account.

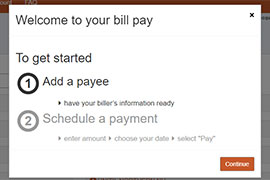

1. Log in to online banking and in the navigation, click on the "Transfers & Payments" category then select "Bill Pay"

2. You'll be asked to set up a security question and accept the Terms and Conditions.

3. It will prompt you to "Add a Payee." Tell us about the person or company you wish to pay.

4. Enter the payment amount and the date the payment should be sent.

5. For recurring payments, select "Make it Recurring" in the payee dashboard.

6. Enter the recurring payment details such as amount, frequency and payment date.

7. Submit!

Solarity Online Banking supports the latest versions of Chrome, Safari and Microsoft Edge. We strongly recommend using the latest versions of these browsers to ensure the best and safest online banking experience, as some features may not display or work properly with outdated or unsupported browsers.

In online banking, click the "Accounts" dropdown and select "Manage eStatements."

On the mobile app, click the "Menu" option at the bottom of your screen and select "Manage eStatements."

From there, select the accounts you would like to receive eStatements.

Please note: If you don’t have access to digital banking, you will need to enroll in online banking before you sign up for eStatements.

Still have questions?

If you aren't able to find the answers you need, reach out to us. We are happy to help!